AI Enablement in Finance: Powering Smart Decisions

- José Eduardo Casillas Guzmán

- Oct 2, 2025

- 5 min read

AI Enablement Is a Data Challenge First

AI has become one of the most promising tools to transform financial operations, improve forecasting accuracy, reduce operational costs, and elevate customer experiences. Yet, despite all the hype, few finance teams are achieving real, scalable value from artificial intelligence.

The problem isn't ambition or investment. It's data.

Many financial organizations operate within a fragmented technology landscape: multiple ERPs (like Oracle Fusion or SAP), legacy systems, POS data, and custom-built software. These systems were never designed for analytics or AI. As a result, companies face a painful truth: you can’t enable AI in finance without first enabling your data.

This is what "AI Enablement in Finance" truly means: building the pipelines, governance, and interoperability that make reliable, actionable data available to intelligent systems—and to the humans who use them.

Why Finance Needs AI Enablement?

Finance teams have always worked with data. But AI changes the game:

Predictive accuracy: Forecast revenue, cash flow, and customer churn more effectively.

Automation: Streamline routine tasks like invoice processing, reconciliation, and reporting.

Risk intelligence: Model fraud, defaults, and credit risks in real time.

Scenario modeling: Move beyond static dashboards to dynamic, data-driven simulations.

Despite these opportunities, finance departments often struggle with:

Siloed and inconsistent data

Limited analytics capabilities within their ERP systems (e.g., OTBI in Oracle)

Lack of governed access to critical datasets

Slow or no integration with modern AI/ML infrastructure

Finance is ready. But the foundation must be activated first.

What AI Enablement Means in a Financial Context

AI Enablement isn’t just about buying or building models. It’s about transforming your data ecosystem so models can work at all.

Key pillars include:

Unified data architecture: Connect structured and unstructured sources (Oracle, SAP, IoT, legacy systems) into a common data layer.

Modern data pipelines: Prepare data continuously with quality and governance in mind.

Cloud-native compute: Scale AI workloads without disrupting core systems.

Security and compliance: Control data lineage, permissions, and usage across teams.

It’s a shift from "data at rest" to "data in motion" = accessible, intelligent, and contextual.

The Role of a Lakehouse in Financial AI Enablement

A Lakehouse combines the structure of a data warehouse with the flexibility of a data lake. For finance, this means:

Consolidating fragmented modules from ERPs into one accessible foundation

Running advanced analytics and ML directly on operational data without overloading source systems

Enabling flexible data models for use across finance, compliance, and strategy teams

Platforms like Databricks enable this Lakehouse vision while allowing finance teams to:

Integrate with BI tools like Power BI or Tableau

Build predictive models with Python, SQL, or notebooks

Manage compliance with tools like Unity Catalog

And with tools like Arkon Data Platform (ADP), the transition from Oracle Fusion or other complex systems into a Databricks-native environment becomes dramatically faster and less disruptive.

Real-World Examples of AI Enablement in Finance

Below are three real examples of how financial institutions have embraced AI enablement by unlocking data, modernizing infrastructure, and applying AI at scale:

Use case 1: Experian

Experian scaled customer support by fine-tuning a GenAI model to automate email responses. Using Databricks Mosaic AI, they reduced model fine-tuning time from 86 to 8 hours, improved NPS by 8%, and handled over 35% of emails without human intervention. The foundation? A secure, flexible, and governed data architecture built on the Databricks Data Intelligence Platform.

Source: Databricks

Use Case 2: HDFC Bank

India's largest private bank modernized its data stack by migrating from a 16-node Hadoop cluster to Databricks. The result: faster queries, improved governance via Unity Catalog, and a unified data platform to fuel AI-driven fraud detection, customer analytics, and campaign optimization. The shift empowered their credit analytics team to focus on innovation instead of infrastructure.

Source: Databricks

Use Case 3: Cash App (Block)

Cash App needed to unify Afterpay data post-acquisition. With Databricks and Delta Lake, they achieved ACID-compliant, cost-effective pipelines across cloud platforms. Their medallion architecture and LakeFlow pipelines enabled real-time analytics and secure, scalable access to critical financial data, empowering teams across risk, finance, and marketing.

Source: Databricks

It Takes More Than Just AI Tools: The Requirements for AI Enablement

To make AI real in finance, you need more than data scientists. You need a data infrastructure that includes:

Semantic layer alignment: So AI understands what “net revenue” or “adjusted EBITDA” means.

Data quality at scale: Automate checks and profiling across billions of rows.

Governed access for humans and machines: With full lineage and compliance.

Robust integration with ERP, CRM, custom systems, and cloud infrastructure

This is where Arkon Data Platform comes in.

How Arkon Data Platform Accelerates AI Enablement in Finance

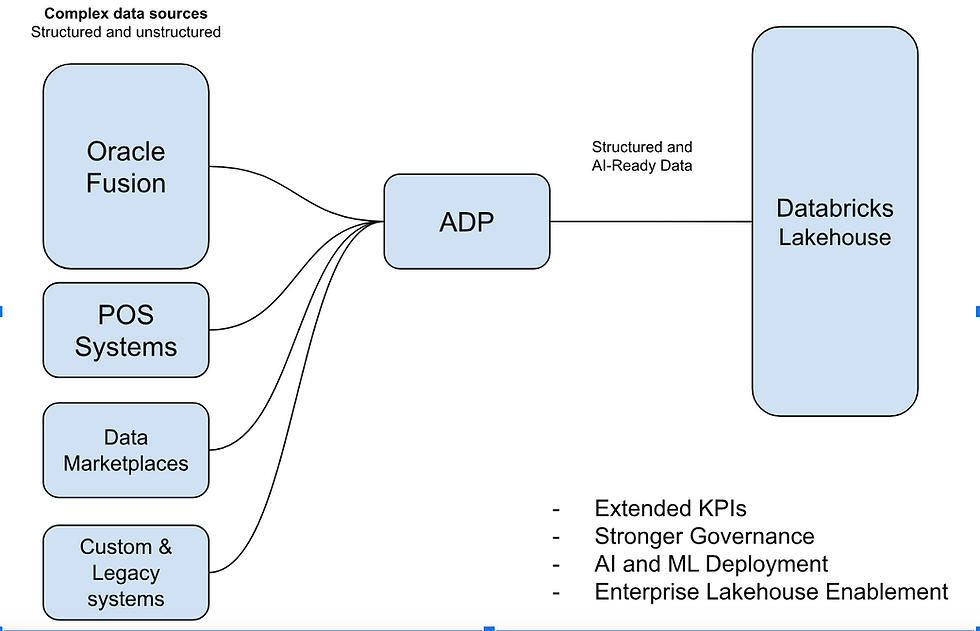

ADP connects and models complex financial and operational data from systems like Oracle Fusion, SAP, POS, and custom-built tools. It then structures that data to feed downstream analytics and AI tools with minimal friction.

With ADP you can:

Build an enterprise lakehouse without disrupting ERP or transactional systems

Enable KPIs and forecasts impossible to build within standard ERP dashboards

Deploy ML pipelines for finance, HR, supply chain, or audit use cases

Govern all your data with Unity Catalog, MLflow, and audit-ready controls

Think of ADP as the bridge between your enterprise data and your AI future.

Conclusion: AI Enablement in Finance Starts with Trustworthy Data

AI won’t magically fix finance. But a well-governed, unified data foundation will unlock capabilities you never thought were possible:

ML-powered forecasting

GenAI-driven reporting and automation

Live insights into cash flow, risk, customers, and cost centers

With platforms like Databricks and solutions like Arkon Data Platform, AI enablement in finance becomes not just possible, but repeatable and scalable.

Whether you’re still dealing with ERP silos or already experimenting with LLMs, one truth holds:

The future of finance starts with data.

FAQs about AI Enablement in Finance

1. What’s the difference between AI enablement and simply adopting AI tools?

AI enablement isn’t about plugging in a model and hoping for results. It’s about creating the data foundation, infrastructure, governance, and operating model that makes AI sustainable, scalable, and aligned with your business. Tools are easy to acquire. Enablement is what turns them into value.

2. Can finance teams enable AI without fully modernizing their tech stack?

Yes, but it’s often inefficient and risky. Many finance teams try to run GenAI pilots on legacy infrastructure, hitting walls with data silos, quality issues, and governance gaps. AI enablement bridges the gap by unlocking value from existing systems (e.g., ERPs, CRMs, POS) and making their data AI-ready without a full rip-and-replace.

3. How can AI be used in finance without creating compliance nightmares?

By leveraging metadata, lineage, and unified governance through platforms like Unity Catalog, finance teams can build traceable and auditable AI workflows. This is especially critical for banks, insurance companies, and fintechs. AI enablement isn’t just about performance; it’s about trust.

4. What’s the ROI of investing in AI enablement first, before AI applications?

AI enablement often reduces the time-to-value for AI by 50% or more. It prevents costly rework, governance issues, and model failures. You also improve data reuse, internal collaboration, and innovation velocity. It’s not overhead, it’s multiplicative leverage.

5. Can smaller finance teams or departments enable AI without a big data science staff?

Yes, that’s why the right platform matters. With tools like Databricks Mosaic AI and structured data pipelines enabled by Arkon Data Platform, even lean teams can build GenAI copilots, forecasting agents, or RAG apps, without needing to build everything from scratch. AI enablement levels the playing field for small and medium companies.